Stock market, often referred to as the heart of the financial world, is a dynamic and ever-evolving marketplace where dreams of wealth creation and financial security take shape. It is the place where companies go public, investors buy and sell shares, and fortunes are made or lost. In this bustling arena, individuals and institutions alike come together to participate in an intricate dance of supply and demand, where every trade tells a story of optimism, skepticism, and the pursuit of financial success. Welcome to the stock market, where opportunities abound for those who dare to understand its intricacies and harness its potential

Understand the Fundamentals of the Stock Market in India

Contents

The stock market in India is a dynamic and vital component of the country’s financial landscape. It provides individuals and businesses with opportunities to invest and raise capital, contributing significantly to the economy. To embark on a journey of understanding the basics of the stock market in India, let’s explore some fundamental concepts:

What is the Stock Market?

The stock market, also known as the equity market, is a centralized marketplace where financial instruments such as stocks, bonds, and commodities are bought and sold. It serves as a platform for investors to trade these instruments, and it plays a crucial role in the functioning of the Indian economy.

Want to know Adani power share price?

Key Players

1. Stock Exchanges

In India, there are two prominent stock exchanges: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These exchanges facilitate the trading of various financial instruments and ensure transparency and fair practices in the market.

2. SEBI

The Securities and Exchange Board of India (SEBI) is the regulatory authority responsible for overseeing the functioning of the stock market. SEBI ensures that market participants adhere to rules and regulations, safeguarding the interests of investors.

Searching for Adani Wilmar share price?

How Does the Stock Market Work?

At its core, the stock market is a marketplace for buyers and sellers. Companies can raise capital by issuing shares, which represent ownership in the company. These shares are later on sold and bought by the investors in the Indian stock market.

1. Stocks

We also describe stocks as shares or equities, which show ownership in a company. Possessing a company’s stock implies holding a stake in its assets and profits. Stocks are categorized into two types: Common and Preferred.

2. Stock Indices

Stock indices, such as the Nifty 50 and the Sensex, are indicators that track the performance of a group of stocks. They provide insights into the overall health and direction of the stock market with nifty share prices.

Investing in the Stock Market

Investing in the stock market offers the potential for wealth accumulation, but it also involves risk. Here we have some of the points to keep in mind:

1. Risk and Return

Stock market investments come with varying levels of risk. Generally, higher-risk investments have the potential for higher returns, but they can also lead to significant losses. It is important to evaluate the risk tolerance before you invest in shares.

2. Diversification

Diversifying your portfolio by investing in different types of assets and industries can help reduce risk. This strategy aims to balance potential gains and losses.

3. Research and Analysis

Before investing, conduct thorough research on companies and industries. Analyze financial statements, market trends, and news that may impact your investments.

4. Long-Term Perspective

Investing in the stock market is often more fruitful when viewed as a long-term endeavor. Time in the market tends to yield better results than attempting to time the market

How to Start Investing in Stocks

If you’re interested in participating in the Indian stock market, here are the basic steps to get started:

1. Open a Demat and Trading Account

A Demat (Dematerialized) account is where your shares are held in electronic form, while a trading account allows you to buy and sell shares. Open these accounts through a registered stockbroker.

2. KYC Compliance

Complete the Know Your Customer (KYC) process by providing necessary documents and details as required by SEBI and your chosen broker.

3. Choose Your Investment Strategy

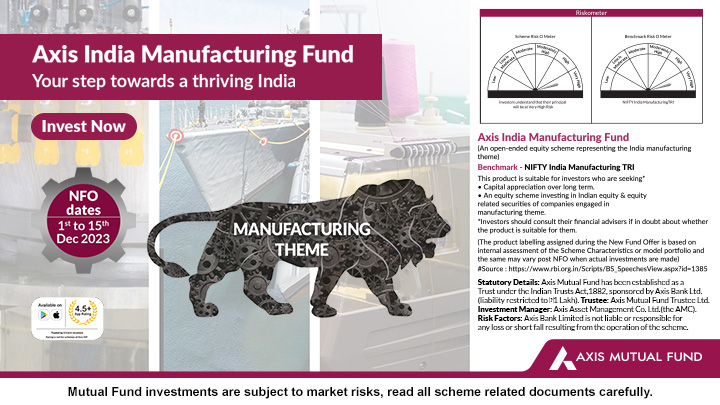

Decide whether you want to invest directly in stocks, mutual funds, or exchange-traded funds (ETFs). Your choice will depend on your risk tolerance, financial goals, and investment horizon.

4. Research and Select Investments

Research companies, sectors, and stocks that align with your investment goals. Consider factors such as financial performance, management quality, and industry trends.

5. Place Orders

Using your trading account, place buy and sell orders for the stocks or investments you’ve selected.

6. Monitor and Review

Regularly monitor your investments and review your portfolio to ensure it aligns with your financial objectives. Get ready for the adjustments as per the needs.

Rundown

Understanding the basics of the stock market in India is a crucial step for anyone looking to venture into the world of investments. While investing offers the potential for financial growth, it’s essential to approach it with knowledge, patience, and a long-term perspective. The stock market plays a pivotal role in India’s economic development, and participating in it can be a rewarding journey for those who take the time to learn and invest wisely.